Beware Of Salespeople Making Ridiculous Electricity Price Increase Predictions

Beware Of Salespeople Making Ridiculous Electricity Price Increase Predictions

A rooftop solar power system is an excellent investment for any home that isn’t at the bottom of a well or otherwise suffering from major shade problems. Earlier this year I wrote an article on payback times in Australian capitals but it’s already out of date as they pay themselves off even faster now. The sun didn’t get any sunnier but solar power did get cheaper. Actually the sun got less sunny, but don’t worry, that’s just a normal part of its 11 year cycle. (It will be decades before solar panels drain enough energy from the sun for it to go out altogether.)

Unfortunately, despite solar power already having an excellent return, some solar and battery salespeople just can’t help gilding the lily by providing potential customers with estimates of savings that include huge increases in the future price of grid electricity. It’s common for these lily gilders to assume annual grid electricity price increases of 10%. There is a technical term for this kind of exaggeration and the term is bullshit. But I’ll leave it up to the experts to decide if it falls into the utter, complete, or pure categories.

The reason it is bullshit is not because after just a few years it would be cheaper to use a diesel generator in South Australia than grid power, but because while Australia has suffered huge increases in grid electricity prices over the past 10 years they have been at an average annual rate of around 7.4% and not 10%. The only way to get a 10% figure is to pick a period of rapid electricity price increase and ignore what happened before and after. And that is not a statistically proper thing to do. It’s a case of lies, damned lies, and salespeople.1

I will explain why I think the most appropriate estimate to use for electricity price increase predictions is 0% real increase. This means it should be assumed electricity prices will simply keep pace with inflation. I’ll also explain what is likely to happen to solar feed-in tariffs over the next few years.

But before I go into this, I’m afraid my identical twin cousin, Donald, wants to talk to you. I didn’t want him bothering you, but he insisted. He’s hoping one of you can help him out, so I’ll turn the article over to him for a few paragraphs…

Hey there! It’s great to not see you! The name’s Donald and have I got a fantastic offer for you!

Today, for a very limited time, I have a beautiful Tesla electric sports car for sale. Let me tell you, I’ve driven a lot of great cars, but this car is the best. It’s almost brand new. Sure, I may have gently bumped it against a cow, but you can hardly see the mark and if you buy now I’ll throw in a free esky full of steak! It’s a steal at only $100,000. That’s far less than what it was when I stole… I mean, when I bought it new.

Now I know what you’re probably thinking, $100,000 is a lot of money and maybe you’re not sure you want to spend that much. But trust me, I’m telling you, this car will save you money. It’s all electric. You’ll make your money back through savings on petrol in no time! You might say you only spend a couple of thousand dollars on petrol a year, but let me tell you, its price is about to go through the roof! And I can prove it to you with maths. Take a look at this graph of the price of oil:

Image: Oil Sands Magazine — But not the pony. (Don’t know how that got in there.)

As you can clearly see, from 2007 to the middle of 2008 the price of oil more than doubled. If this trend continues, — and trust me that it will because my word is worth far more than real evidence ever could be — in one year the $2,000 you spend on petrol now will become $3,500. The year after that it will be $6,000. In five years time you’ll be spending $31,000 a year on petrol and in just 10 years you’ll be spending $473,000 on petrol annually. Clearly, you’d be nuts not to buy this beautiful car from me, along with an esky full of meat, for the low price of only $100,000. Cash. Preferably in a brown paper bag…

Okay, you can stop right there, Donald. We’ve heard more than enough. I’m sure no one here wants to buy your cow killer. And what have you done with that graph? Here’s what it looks like in full without the pony:2

Image: Oil Sands Magazine (No pony this time, but I hear the centrefold’s pretty slick.)

Now people can see the full graph it’s clear the run up in price you mentioned was only temporary and you cherry-picked the dates to make the price rise that occurred appear as dramatic as possible.

But since graphs have been brought up, I’ll show everyone some that are relevant to the topic of future electricity price increases. But first I’ll warn everyone this article isn’t for the faint-hearted. Things are going to get pretty graphic.

Here’s a graph I stole from ABC News. It shows the increase in residential electricity prices since the middle of 1990 but it only goes until the end of the 2016-2017 financial year. It would be nice if it was completely up to date but I couldn’t find a better one to steal and I have far too many cartoons to watch to take the raw data and make my own graph. It shows the real increase in household electricity prices. This means the effects of inflation have been removed:

(Image: ABC News)

The yellow line is the average for Adelaide and the eastern capitals and is called “National” despite leaving out Perth and Darwin. It shows that in the final 10 years of the graph the average electricity price increased by 63%. That’s a hefty amount but it doesn’t mean the average annual increase was 6.3%. Instead it was only 5% on account of maths.[1 Because it works like compound interest a 5% annual increase will result in a 63% increase over a 10 year period.]

But these figures have had the effects of inflation removed. During that period the annual average inflation rate was 2.4%. This will make the average annual electricity increase including inflation 7.4%. I don’t care how hard you think maths is, you do not get to round that up to 10%. Only physicists get to do that.

There is no particular reason for basing estimates of future electricity price increases on just the past 10 years. If we look at 20 years instead we get a very different answer. Instead of a 5% real annual increase it’s only 3%. Looking at the past 30 years gives an ever lower figure. If anyone wants to argue we should look at the past 10 years instead of 20 or 30 because the recent past is going to be a better indicator of the future then they need to explain why looking at just the final 4 years on the graph wouldn’t be even better — a period in which electricity prices have declined in real terms.

The period in which electricity prices soared for the sky like some kind of rocket man has been over for years now. I’m in rural Queensland at the moment and Ergon’s per kilowatt-hour charge is two-thirds of a cent lower than it was last year. While definitely not everyone has received a decrease, no one’s getting the crazy increases we were being hit with 7 years ago.3 They are not likely to return because:

But you don’t have to take my word for it. You can take someone else’s word for it.

Here’s a graph from a 2017 report by Jacobs Analysis. It’s their mid-range prediction for residential electricity prices and has been adjusted for the effects of inflation:

Clearly they are not perfect at predicting as we haven’t had the huge electricity price increase over the past year they expected. But despite this inaccuracy I’d still say they’re probably better at this than the average battery salesperson. As the graph shows, they don’t see a return to massive price increases all the way out to 2037.5

More evidence that electricity prices probably aren’t going to rise comes from the price of future contracts for wholesale electricity. Future markets operate on the principle of pay now — get later. A large user of electricity can put down their money and buy a contract that guarantees them electricity at a fixed rate in the future and lets them eliminate uncertainty. This graph was made by the ACCC using the future prices for wholesale electricity on the first of June this year:

They expect prices to be higher in summer, but this is normal and the peaks get lower over time. As you can see, there is not a significant change in the average price of wholesale electricity in the futures market over the next two and a half years.

If the people flogging futures contracts are keeping their prices fairly constant over the next two or three years, then it seems reasonable to assume they aren’t expecting much change in the price of wholesale electricity. But that’s not quite how it works. Because they want to make a profit, the cost of a futures contract will always be a little higher than what the person selling it expects the wholesale spot price of electricity to be when it comes due. Also, the further in the future you want the electricity the harder it is to predict what the price will be and so they increase their margin to allow for that uncertainty. This means if the people selling future contracts hold their prices more or less constant it actually means they expect wholesale electricity prices to fall.

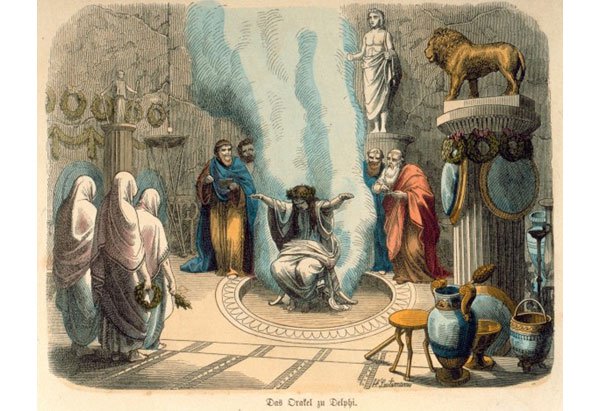

This does not mean they expect electricity prices to fall by a large amount. Competition keeps their margins thin and prevents them from making a huge profit. But they are expecting a downwards trend and I’m inclined to agree with them on this. The future markets definitely aren’t always right, but they are our best method of predicting the future and are probably more accurate than Greek women huffing volcanic fumes.

“Beans, beans, the magical fruit. The more you eat, the more you toot. The more you toot the better you feel, beans, beans for every meal!”

If wholesale electricity prices fall then solar feed-in tariffs may also fall. This is a something that generally isn’t mentioned by the sort of salespeople who make padded predictions about electricity price increases. As the fall in wholesale prices is only likely to be mild over the next two to three years, there shouldn’t be much downward pressure on feed-in tariffs. But wholesale prices could fall more during the day than at night and so increase the likelihood of feed-in tariff cuts. On the other hand, it is possible for solar feed-in tariffs to increase if some of the additional benefits of rooftop solar panels are priced in, similar to what currently occurs in Victoria.

Battery salespeople often don’t mention solar feed-in tariffs at all. Because they have the effect of reducing the return from batteries they may simply not mention them in the hope their customer — or in this case victim — won’t realize they make the return from a battery much worse. This is crappy behavior and puts the installer in a precarious legal position. Under Australian consumer guarantees it is required that goods…

So if an installer tells you a solar battery will save you money and gives you a savings estimate that doesn’t account for the effect of feed-in tariffs, then you are entitled to a refund if you don’t save as much as they indicated. I wouldn’t be surprised if there are many new battery owners in Australia entitled to a refund because they are not getting the savings promised to them.

I say the most reasonable approach for salespeople to take when predicting future grid electricity prices is to simply assume they will remain constant in real terms. In other words they will just keep pace with inflation. I actually expect electricity prices will gradually decline, but assuming they will keep pace with inflation is simple and easy for people to understand and so should be the method that’s used.

If salespeople want to want to include a high and a low estimate as well that’s fine, but the estimates should be reasonable and they should point out there is no good reason to expect electricity prices to increase as opposed to hold steady or fall.

When it comes to solar feed-in tariffs, salespeople should point out that at the moment they look more likely to fall than increase unless the methods used to determine them are changed. Battery salespeople need to correctly describe the effect feed-in tariffs have whenever they give information on the potential return from a battery system.

The bullshit needs to stop. Using an estimate for annual electricity price increases that can only be obtained by cherry-picking a period in the past and ignoring what happened both before and after is flat out lying to customers. Consumer law will entitle people to refunds if this is done and the people who mislead customers this way are no better than my cousin Donald who takes pleasure in manipulating others by getting them to accept figures that support his agenda.